Not Rich But Wealthy

Over the last 12 months I’ve read several versions of a financial article that discusses the plight of the high-income earner in America. Most focus on a family, hypothetical or real, that earn $200,000 a year or more and yet only have a few thousand left for savings after all expenses are accounted for. These families insist they aren’t rich, despite their ability to spend lavishly on education, cars, vacations, expensive homes, and the like. Bruce Bartlett recently wrote an article examining the economic policy impacts of this “not rich” mindset

For those that don’t know me well, I am a hip-hop fanatic. While listening to Kendrick Lamar’s album Section .80 years ago, I was struck by a lyric in his song “Poe Man’s Dreams.” As he describes his experiences and philosophies on life:

I like to start it out from the bottom and build with ya

Be on my last dollar and split the bill with ya

I'm 23 with morals and plans of living cordial

Not rich, but wealthy, there's nothing you can tell me

Not rich, but wealthy. A concept that I see very clearly in Bruce’s article and that has significant implications as to how we live our lives.

Money is an unavoidable aspect of life. No matter how much or how little we have, we all must engage with money at some level. So why is it that studies show the more money we have, the less happy we are? How can we live a truly wealthy life?

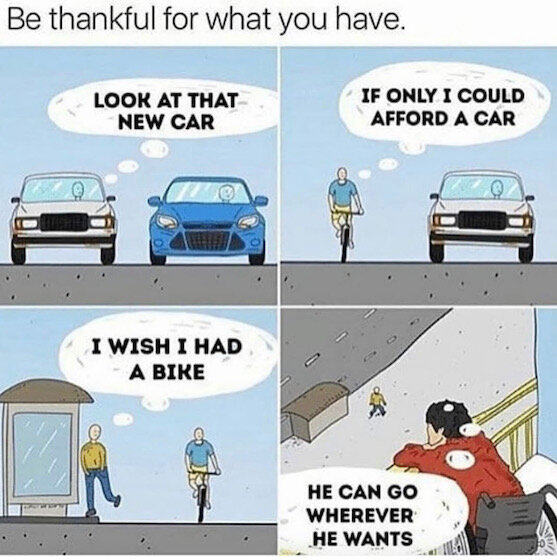

First – perception is reality. People rarely feel “rich” because they can always point to someone with more money, more access, more things. We compare ourselves upwardly instead of comparing downwardly.

There will always be someone that has more than we do, that’s a fact. And this is not to say that we shouldn’t aspire to more, an ambitious mindset is a wonderful thing. However we can aspire to more while also being grateful for our circumstances – for our wealthy life. In changing our perception – in comparing ourselves to those that have less instead of those that have more – we move to a mindset of gratitude and appreciation, a big component of living wealthy.

Second – realize that “money without meaning is just paper.” Interestingly, a wealthy life has nothing to do with the amount of money you have. Rather, a wealthy life is a product of using your resources (your T.E.A.M, as I call it – Time, Energy, Attention, Money) on the things you truly value. Those aspects that are essential to your most meaningful life. Allocating your resources intentionally to provide those feelings of true satisfaction and wealth.

So how do we bring meaning to our money & increase our feelings of wealth?

1 – Determine what is truly essential

Before we can begin to use our resources intentionally, we must first identify what is most meaningful to us. As a financial life planner, I use George Kinder’s EVOKE® process to help clients identify what is truly essential to living their most fulfilled life. Kinder’s 3 questions are a significant piece of that process, a description can be found here: https://snip.ly/2dawhq

2 – Allocate T.E.A.M. according to your vision

Once we understand what is most essential, we can start allocating our resources intentionally. A few examples to illustrate this point:

A couple making $60,000 / year determined that charitable giving is a top priority in their lives. They understand that their finances only allow for a certain level of financial impact. In examining their budget they are able to comfortably allocate $10,000 / year in charitable gifting. In examining their calendar they are able to comfortably allocate 10 hours / month towards their impact as well. Impact provides meaning to their lives and they achieve it within their available resources.

A CEO with a net worth in the 9 figures determines that freedom and flexibility provide the most meaning in her life. This person could easily purchase almost any home or vacation home anywhere in the world, anytime. She consciously avoids real estate ownership at every turn, renting her primary residence and renting any vacation home she chooses. Why, when real estate ownership seems to be a builder on long-term wealth? Because, in her words, “I can go anywhere I want, for any amount of time, and then leave with no responsibility to that place. No maintenance and upkeep. No taxes and insurance to pay. No responsibility whatsoever. And that, to me, is most essential.”

Two examples of a wealthy life, from two very different ends of the financial spectrum. The couple in our first example could work their way up the income ladder and allocate more money towards their causes. But giving their time was just as meaningful, if not more meaningful, than the money they could give. They understood that the trade-off – giving more time to work and less time to charity – would not bring them more satisfaction. As with the CEO in our second example understood that owning more assets – building more net worth – would not bring more meaning to her life. In fact, it would detract from the freedom that she finds so essential.

Our goal is to help as many people as possible live their most meaningful, most wealthy lives. Money, by itself, does not create fulfillment. Money without meaning is just paper. I encourage everyone – talk to a financial life planner. Go through Kinder’s 3 questions. Identify the truly essential aspects of your life and allocate your T.E.A.M. to those things. Minimize the resources you give to everything else. Aspire to live not rich, but wealthy.